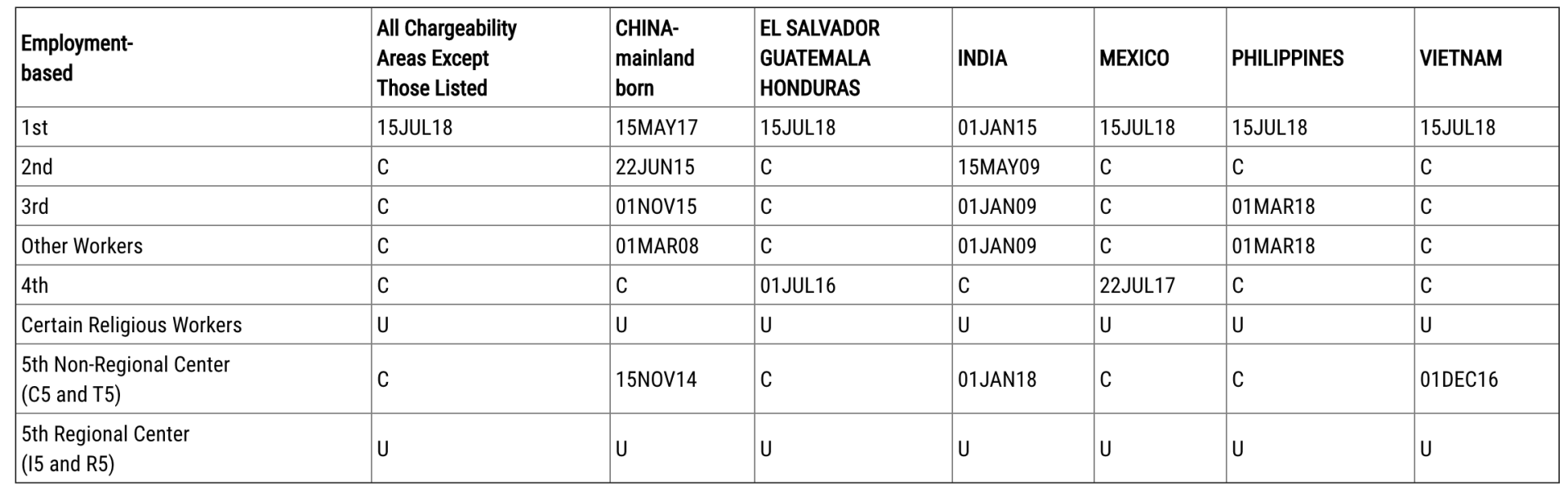

Eb-5 New Regulations

Thinking about applying for an EB-5? Apply now! This is the best time to do it!

Under the current EB-5 law an EB-5 investor must invest $1 million in a new U.S. commercial enterprise and that investment must result in the employment of 10 new American workers. Additionally, if the EB-5 investor invests $500,000 in a qualified targeted employment area (TEA), which is defined as an area having an unemployment rate of 150% or more of the national average or a designated rural area they also may qualify for a permanent green card under the EB-5 program.

Pursuant to 8 U.S.C. 1153 (b)(5)(C), DHS consulted with the Departments of State and Labor to increase the minimum investment amounts for all new EB-5 petitioners in this final rule. See final 8 CFR 204.6 (f). The increase will ensure that program requirements reflect the present-day dollar value of the investment amounts established by Congress in 1990. Specifically, consistent with the NPRM, the rule increases the standard minimum investment amount, which also applies to high employment areas, from $1 Start Printed Page 35752million to $1.8 million. Final 8 CFR 204.6 (f)(1), (3). This change represents an adjustment for inflation from 1990 to 2015 as measured by the unadjusted Consumer Price Index for All Urban Consumers (CPI-U), an economic indicator that tracks the prices of goods and services in the United States. This rule also makes a technical correction to the inflation adjustment formula, so that future inflation adjustments will be based on the initial investment amount set by Congress in 1990, rather than on the most recent inflation adjustment.

For investors seeking to invest in a new commercial enterprise that will be principally doing business in a TEA, the proposed rule would have decreased the differential between TEA and non-TEA minimum investment amounts to 25 percent, thereby increasing the TEA minimum investment amount to $1.35 million, which is 75 percent of the increased standard minimum investment amount. However, based on a review of the comments, the final rule will retain the 50 percent differential, and only increase the minimum investment amount from $500,000 to $900,000. Final 8 CFR 204.6 (f)(2).

For more information please visit https://www.federalregister.gov/d/2019-15000/p-92